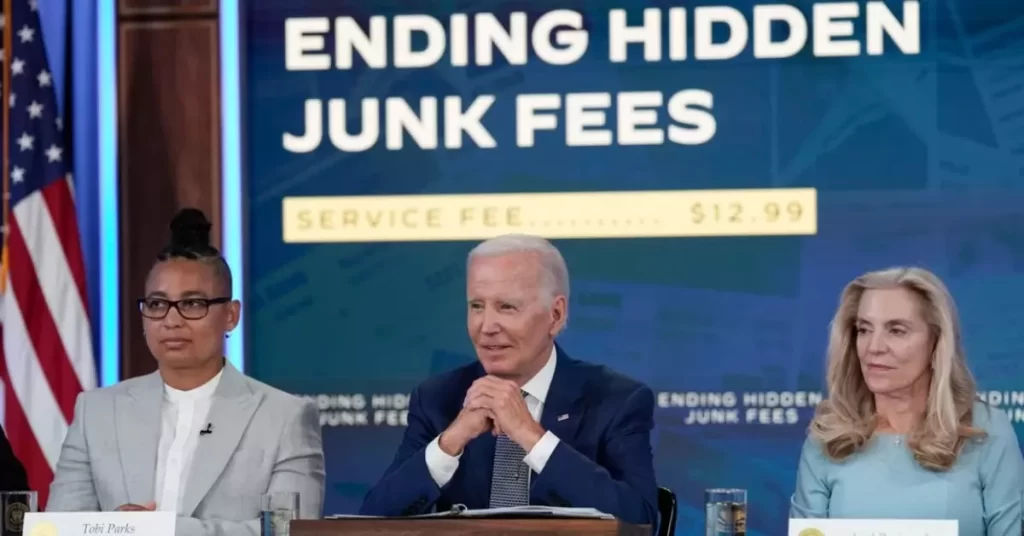

President Biden Targets ‘Junk Fees’: The Quest for Consumer Savings

As millions of Americans experience the frustration of encountering hidden fees during their online purchases, President Joe Biden‘s administration has taken a stand against these so-called “junk fees.” With a focus on airline charges, banking fees, and resort surcharges, the White House aims to protect consumers and promote market competition. Despite the laudable intentions, experts question whether this crackdown will result in substantial savings for Americans, as businesses may find alternative ways to maintain their revenue. This article delves into the complexities of the “junk fees” issue, exploring the potential impact on consumers, businesses, and the economy.

The Prevalence of “Junk Fees”

The exasperation of discovering unexpected fees added to a purchase has become a common occurrence for millions of Americans. Often referred to as “junk fees,” these additional charges can significantly inflate the final cost of a product or service, leaving consumers feeling deceived and financially burdened. In response to these concerns, President Biden’s administration has made it a priority to eradicate such fees and protect consumers from what they view as unfair and deceptive business practices.

The Targeted Fees

The Biden administration’s efforts to combat “junk fees” encompass various sectors, including airlines, banks, and resorts. Charges related to airline family seating, baggage handling, booking, overdrafts, bounced checks, and late credit-card payments are among the key focuses. Resort fees, which have drawn significant criticism, are also under scrutiny. These fees, often hidden in the total pricing of hotel stays, cover amenities like gym and pool access. The administration aims to shed light on these fees, making comparison shopping more accessible and saving Americans from overpaying.

Challenges in Eliminating “Junk Fees”

While the intent behind targeting “junk fees” is commendable, experts express skepticism regarding the effectiveness of such measures. They argue that businesses may find alternative ways to recoup their revenue, leading to a “game of whack-a-mole.” As one fee is curtailed, another may emerge elsewhere, leaving consumers with little relief.

The Impact on Businesses

Businesses may react to the crackdown on “junk fees” by either incorporating the fees into the total pricing or increasing fees in other areas. Resort fees serve as an example, where hotels might choose to raise the overall room rate rather than itemizing specific charges. The resulting lack of transparency could make it challenging for consumers to discern the actual costs, potentially leading to further frustration.

The Ever-Shifting Nature of Fees

The fluidity of fees presents a significant challenge for consumers. For instance, automated teller machine (ATM) fees have seen fluctuations, with the average fee charged by ATM owners reaching a record high in 2022. Simultaneously, the average overdraft fee declined by approximately 11%. This demonstrates how adjustments in fees can create an unpredictable environment for consumers.

The Debate Over Capping Fees

Among the proposed measures, the Consumer Financial Protection Bureau (CFPB) has suggested lowering the cap on credit card late fees to $8, a substantial reduction from the current caps. While this move is intended to benefit low-income Americans, some experts express concern that it could lead to higher interest rates. The delicate balance between reducing fees and maintaining the viability of credit services remains a contentious topic.

The Quest for Transparency

Despite the complexities surrounding the crackdown on “junk fees,” there is hope that it could lead to increased transparency. Recently, ticketing giants like Live Nation, Ticketmaster, and SeatGeek agreed to publish all-inclusive ticket prices to simplify the purchasing process for customers. This move, seen as a “huge win for consumers,” highlights the potential for more companies to adopt honest and transparent pricing practices.

The Consumer Impact

While the push against “junk fees” aims to empower consumers, some doubt how much money individuals will genuinely save. Experts contend that more disclosure does not necessarily equate to more savings. Consumers must exercise their freedom to choose where they spend their money, yet limitations, particularly in sectors with few alternatives like airlines and concerts, may hinder this ability.

Conclusion

President Biden’s administration’s initiative to eliminate “junk fees” and protect consumers from hidden charges represents a significant step toward promoting transparency and fairness in business practices. However, as experts caution, the issue is multifaceted, and potential challenges, such as fee reallocation or increased interest rates, may impact the effectiveness of these efforts. Ultimately, achieving a balance between consumer protection and the stability of businesses will remain a critical consideration as the nation strives for a more equitable and transparent marketplace.